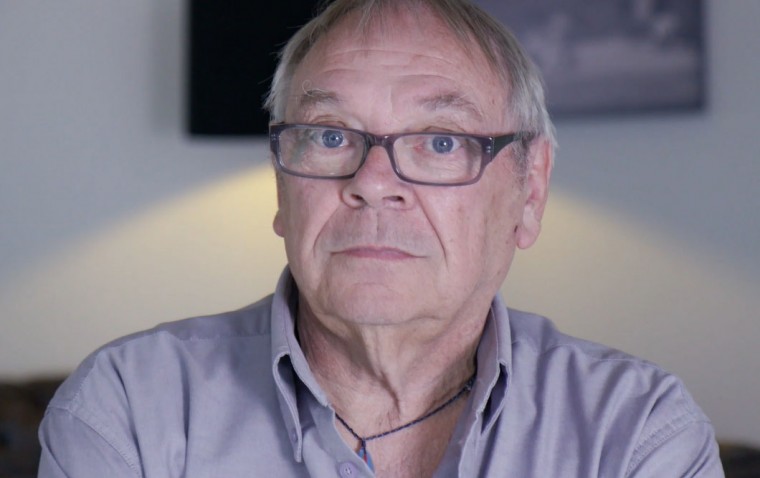

Malcolm noticed that he may have been mis-sold a pension annuity, which meant that he and his family were potentially missing out on financial benefits.

What happened

In 2018 Malcolm discovered that due to health issues he had at that time, he may have been mis-sold a pension annuity that he bought back in 2008. When Malcolm brought his complaint to the company, they didn’t agree and told him that the annuity had been sold correctly. Malcolm didn’t feel that his health issues were properly considered and felt his complaint was dismissed unfairly by the company. So Malcolm contacted us.

Watch Malcom's story to find out how we helped

Pressing play on the video above will set a third-party cookie. Please read our cookie policy for more information.

What we said

We looked into Malcolm’s case and decided that the company had not provided Malcolm with enough information at the time and had therefore mis-sold the annuity.

The business agreed to pay compensation and Malcom’s monthly payments were increased. The outcome has meant that Malcolm has more money to spend on himself and his family. Malcolm found the ombudsman process simple to access and use and felt that a pressure was lifted from him when we got involved.

It's been a very easy process. It's free – and they treat you as an individual.

How we can help you

We can help with all sorts of pensions problems. We only look at complaints that a financial business has had a chance to look at first.

This means that, even if you bring your complaint straight to us, we still need to give the business an opportunity to respond to the complaint and put things right.

If you’ve complained and a business hasn’t responded within the time limits or you disagree with their final response, then we can start to look into it.